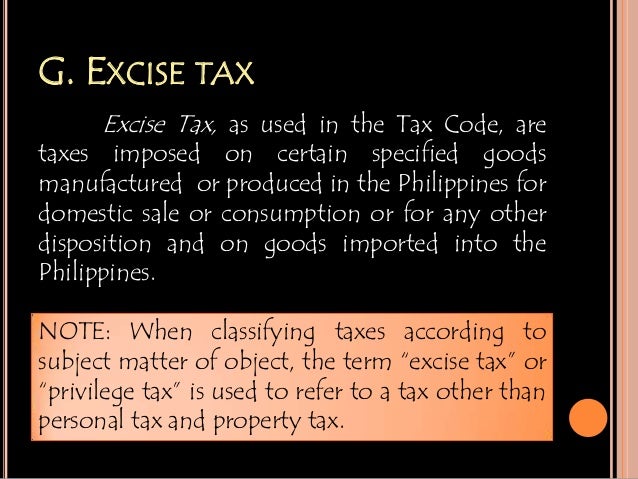

Definition Of Exercise Tax

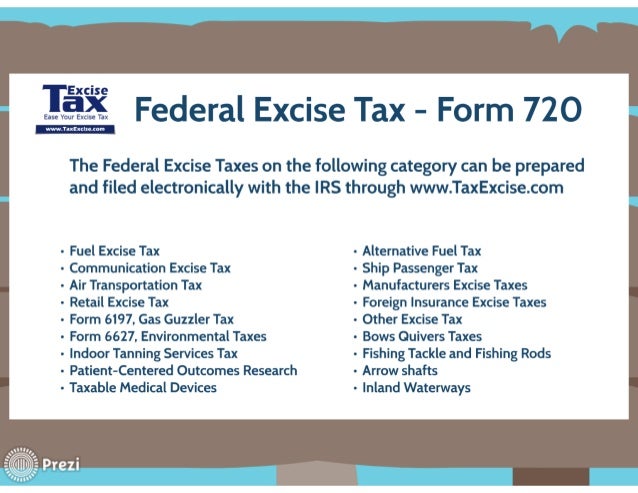

Definition Of Exercise Tax. Federal excise tax is usually imposed on the sale of things like fuel, airline tickets, heavy trucks and highway tractors, indoor tanning, tires, tobacco and other goods. excise tax: [noun] a tax on certain things that are made, sold, or used within a country : excise. This includes tobacco, alcohol, highways, fuel, etc.

Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

A tax imposed on the performance of an act, the engaging in an occupation, or the enjoyment of a privilege.

Generally speaking, in the United States these taxes are levied at the time of production or when the service is performed. Detailed Explanation: Excise taxes are usually paid by the producer and "passed through" to the consumer in the form of a higher price. S. has expanded the definition of items on the excise tax lists as trusts for highways, airports, vaccines, black lung, oil spills, etc. have been set up.

Rating: 100% based on 788 ratings. 5 user reviews.

Olivia Paine

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Definition Of Exercise Tax"

Post a Comment